Business Critical Systems: Where Does the Value Accrue?

Part I/IV

ERP systems can provide competitive advantages to multinational businesses, from core business ops all the way down the supply chain. However, in our view, due to their complexity and consequent inability to tailor easily to all specific needs (incl. generally keeping up with the pace of change in the world), there is room for several best-in-class point solutions to rise - and perhaps eventually rival existing ERP systems.

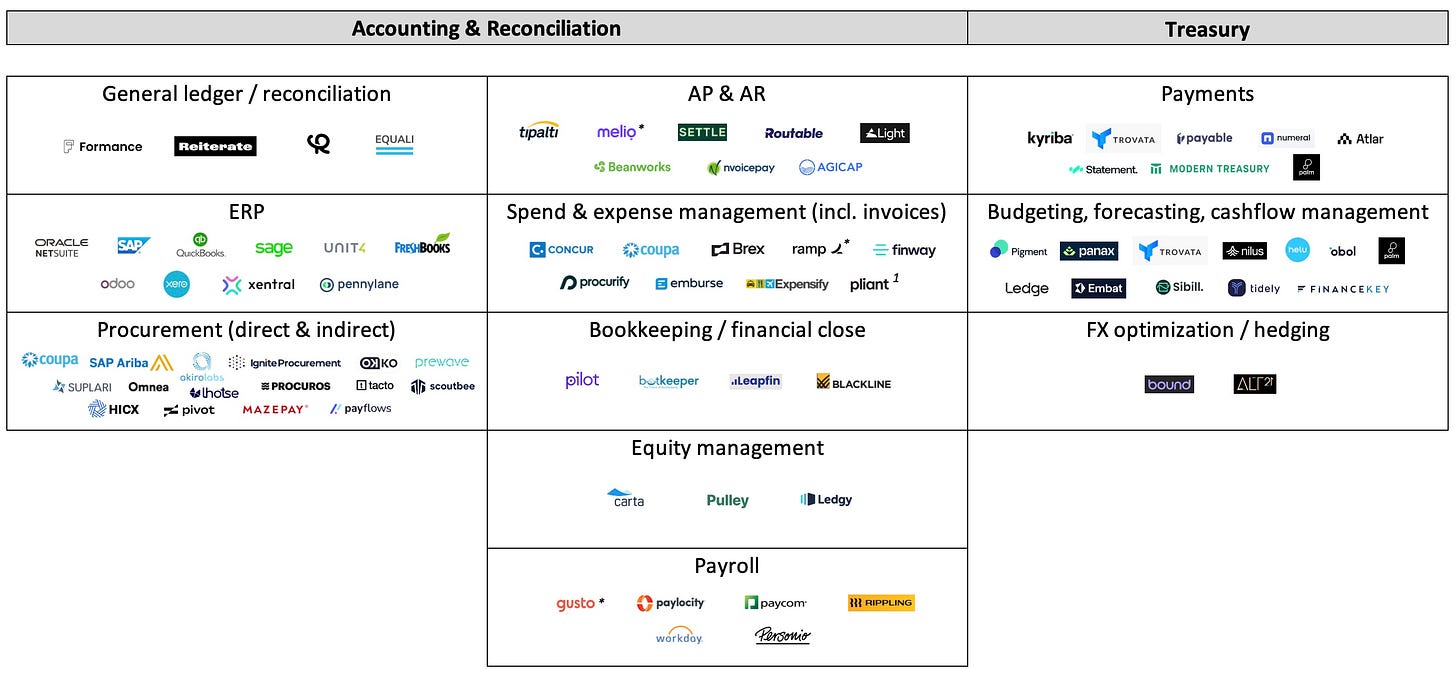

In this series of articles, we deep dive into those mission critical point solutions that we believe world-class teams cannot do without. The point solutions comprise core accounting functions inherent in ERP systems today - procurement functionality, AP & AR, treasury, and reconciliation.

Overview

Data and cash are the lifeblood of any business. Two critical systems through which data and cash flow are a general ledger and a bank account (for payments). A general ledger is usually part of a company’s enterprise resource planning (ERP) system’s accounting module while a business bank account can be opened with most banks. Most companies start their life with a light-weight accounting tool and a bank account, but over time they end up adding on a myriad of additional tools to improve their financial stack.

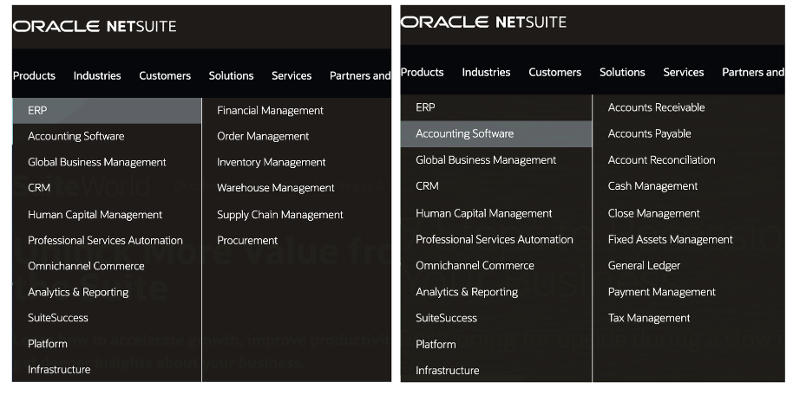

A review of three well-known ERP software systems globally (SAP, Oracle and Microsoft) shows that their product suite covers necessary functionality, in theory requiring no additional tooling. Why do companies still choose to double-pay for certain features, like account receivables and payables automation or even financial budgeting and scenario planning?

The short answer is traditional ERP software systems have a few shortcomings. Their size and breadth simply mean that they cannot constantly be best-in-class for all their modules. This issue is not unique to the ERP space - it’s how big platform software ecosystems work. For example, commercial database systems have connectivity features, yet ETL (extract, transform, load data) is a huge industry. Salesforce is super feature rich and yet has a massive ecosystem of competitors around it.

Once a business signs up to an ERP system, the ‘share of wallet’ question also becomes inevitable due to the ERP’s large product offering, which affects pricing. If a company has limited cash to spend on ERP system features, they are likely to purchase the core business functionality first. Where they spend their budget next depends entirely on the type of business in question, especially their stage/scale and current business priorities.

Third party logos are included for illustrative purposes only and do not imply affiliation or endorsement by such firms or businesses, nor do they reflect Motive Partners or GC investments (unless otherwise noted). The companies herein were selected based on our view of the market, which is subjective in nature. *Denotes a General Catalyst investment. 1. Denotes a Motive Partners investment.

If you think you belong in this chart, please message us. We will be updating it regularly.

What is an ERP?

Enterprise resource planning (ERP) refers to a type of software that organisations use to manage day-to-day business activities such as accounting, procurement, project management, risk management, and supply chain operations. A complete ERP suite also includes enterprise performance management - in short, it’s a piece of software that helps businesses plan, budget, predict, and report their financial results.

ERP systems are comprised of different modules, each focussed on different functions. One of the core modules is the general ledger (GL) - the heart of the ERP system. It’s a database that acts as a ‘single source of truth’, being a collective summary of all business transactions. In accounting, GLs show actual amounts spent or received and are used to draw up financial statements. In theory, it enables businesses to know in real time what is owed to whom and where the money is.

Why are ERP software systems difficult to build and why do alternative solutions exist?

Diversity of Data: ERP implementations can be a finance manager’s nightmare, requiring data collection across suppliers and partners followed by data imports from every record (down to paper) used to store information. The data includes everything from costs of raw materials through terms of supply chain components, tax structures and shop floor regulations. The very design of supporting information systems capturing the levels of diversity and flux of information required has historically been difficult.

Accounting & Tax Codes: ERP systems implementation is increasingly driven by regulatory reporting requirements (Sarbanes-Oxley Act in the USA and International Accounting Standards in Europe and Asia) (Olson, 2005). Global ERP systems not only have historical records of all country-specific tax and accounting standards, but also keep up to date on changes through their local network of tax accountants. The Integrated Reporting initiative (part of IFRS) allows businesses to connect financial statements and sustainability-related financial disclosures and stay on top of all tax and accounting requirements, see SAP’s integrated report as an example.

Country-specific tax and accounting standards make it very difficult for incumbent ERP software systems to consistently offer the same product status quo across every market. Building a new ERP system from scratch is also hard for this reason: large vendors (Oracle and SAP) have ~1-2k employees deployed globally to chase tax codes. From what we’ve seen, founders faced with these challenges often choose to either create a best-in-class global point solution or instead they focus on a certain geography or customer segment.

As investors, we witnessed several point solutions rise in Europe throughout 2022-23. The ERP category in Europe is particularly complex, in part due to the fragmentation created through the European Commission’s 650 tax codes. This has given rise to many geography-focused accounting and ERP solutions for the SME category like Visma, Datev, Cegid and some international SME ERP software tools were successful in winning the UK like Xero (who have struggled in conquering France...).

Most companies get started on the local ERP and only start facing problems upon internationalising and creating new entities. Their only multi-entity and multi-geo option is to switch to SAP, Oracle Netsuite, Workday or Microsoft Dynamics - however, for the reasons listed above, most finance teams dread a major ERP implementation and are looking for new offerings to streamline their existing operations instead.

Long term product positioning

We believe the relationship between incumbent enterprise focussed ERP systems (like SAP, Oracle Netsuite, Microsoft Dynamics etc.) and emergent venture opportunities (setting out to create best-in-class, point solutions, enhancing core ERP functionality in different regulatory markets) is a highly sensitive one. The relationship is usually one of cooperation until ‘enhancing’ turns into ‘competing’. When venture opportunities gain too much scale, ERP systems will start feeling threatened. Venture backed opportunities then either get acquired (SAP take-private of Ariba for $4.3Bn in 2012), go public (like Coupa did in its 2016 IPO during which the company was valued at $1.6Bn) or eventually replace existing ERP systems (no real precedent yet 👀).

Where do we think the current ERP lacks (where the opportunity lies)?

Today ERP systems are complex, offering little to no automation or AI functionalities. They are costly to implement and the pricing plans are often “per seat” so discourage engagement.

This means that most companies either build parts of the ERP stack themselves, start using start-up point solutions or limit use to one seat, access details to which have to be swapped between employees. We believe per seat pricing is the most counter-productive decision made by global ERP providers to streamline business operations for today’s global companies that encourage flat hierarchy and individual ownership.

Here’s the crux of the problem: most businesses cannot replace having an ERP system because of the need to set up and maintain core accounting functions. Follow this series if you are interested in learning about key point solutions and their path to growing share of wallet.

Disclaimer

Views expressed through media like this site (including podcasts, videos, newsletters, and social media) are those of the individual GC or MCM associate who created or wrote the content and are not the views of General Catalyst Group Management, LLC, (“GC”), Motive Capital Management, LLC (“MCM”) or their respective affiliates. GC and MCM are investment advisers registered with the Securities and Exchange Commission. Additional important information about GC and MCM, including Form ADV Part 2A Brochure for each firm, is available at the SEC’s website:

http://www.adviserinfo.sec.gov

Content created by individual GC and MCM associates is not directed to any investors or potential investors, and do not constitute an offer to sell — or a solicitation of an offer to buy — any securities, cryptocurrencies, or any financial instrument or property, and may not be used or relied upon in evaluating the merits of any investment. Nothing here should be construed as or relied upon in any manner as investment, legal, tax, or other advice. Any projections, estimates, forecasts, targets, prospects, or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Any charts or figures provided here are for informational purposes only, and should not be relied upon when making any investment decision. Certain information contained in the content has been obtained from third-party sources. While taken from sources believed to be reliable, no one has independently verified such information and there are no representations about the enduring accuracy of the information or its appropriateness for a given situation.

To the extent any content authored or provided by any GC or MCM associate in this forum or medium makes reference to any company in which any of the funds or vehicles advised by GC or MCM may have an economic or financial interest, previous or current, none of the information provided or opinions expressed herein are connected in any way with GC’s or MCM’s business activities, and GC and MCM did not provide any information or assistance in the creation of this content.

Nothing in this or any other posts or other media content produced by GC and MCM is intended as, nor should it be viewed as, legal, accounting, or tax advice. Please consult and rely on your own professional advisors in those areas.