Marketplace payments are complex and expensive

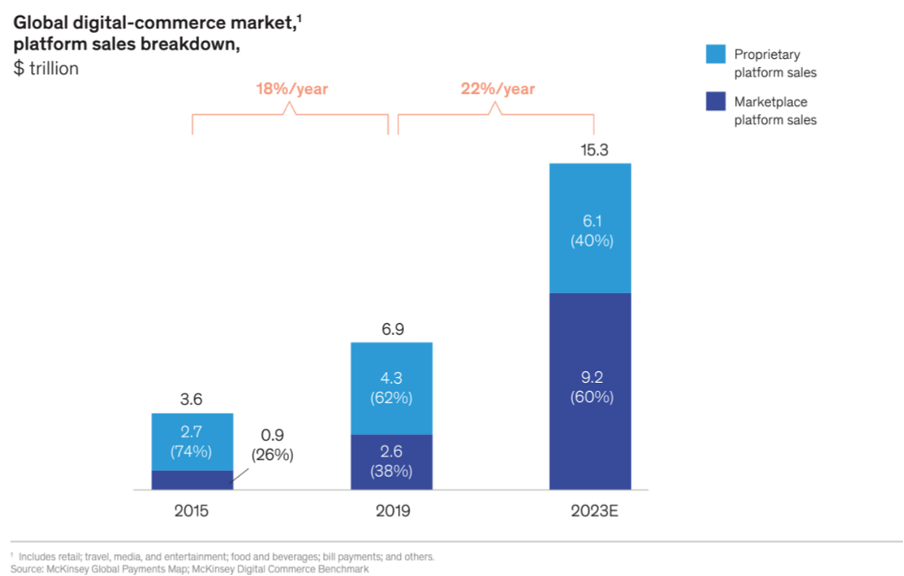

The market opportunity for companies that automate payments for marketplaces, or any fast-growing multi-party platform, is huge. According to McKinsey, digital marketplaces are expected to account for about 60% of digital-commerce volume in the next few years reaching $9Tn. KYC/KYB, pay-in routing, tokenisation, split payments, reconciliation, multi-currency pay-outs - marketplaces usually require all these payments functionalities at once. As we see it, only mega-marketplaces, such as Booking.com, Delivery Hero and Uber, can justify the massive investment in people, regulation and technology required to build the payments infrastructure for effortless instant global commerce.

Why now?

While one-stop shops allow marketplaces to go live quickly, they are not tailored towards fast growing companies. Most small marketplaces are happy to work with bundled solutions (even at prohibitively high take rates), until they start growing payments volume and scaling internationally.

Due to an explosion of different local payment methods in the last decade, marketplaces are increasingly required to adopt local payment options as they expand internationally. One-stop shops not only create dependency but also lack localisation and customisation.

For example, if you are selling products in Africa, most one-stop shops only work for card payments although Africa is a mobile-money payments market. Many one-stop shops lack multi-payment method reconciliation and they often lack multi-currency pay-outs. When the number of supported pay-out currencies are limited, marketplaces are required to settle via cross-border transfers, which are slow and expensive. Managing an increasingly complicated set up of payment solutions soon requires an in-house dedicated payments team in order to avoid payment siloes.

In summary, we believe marketplaces like Airbnb*, Booking.com and Delivery Hero had no choice but to build their payments operations in house. We think this is soon to change, as a new generation of multi-party payments platforms are de-coupling payments processing from payments operations and creating a single source of truth that will allow marketplaces to scale payments volumes globally.

Where to start?

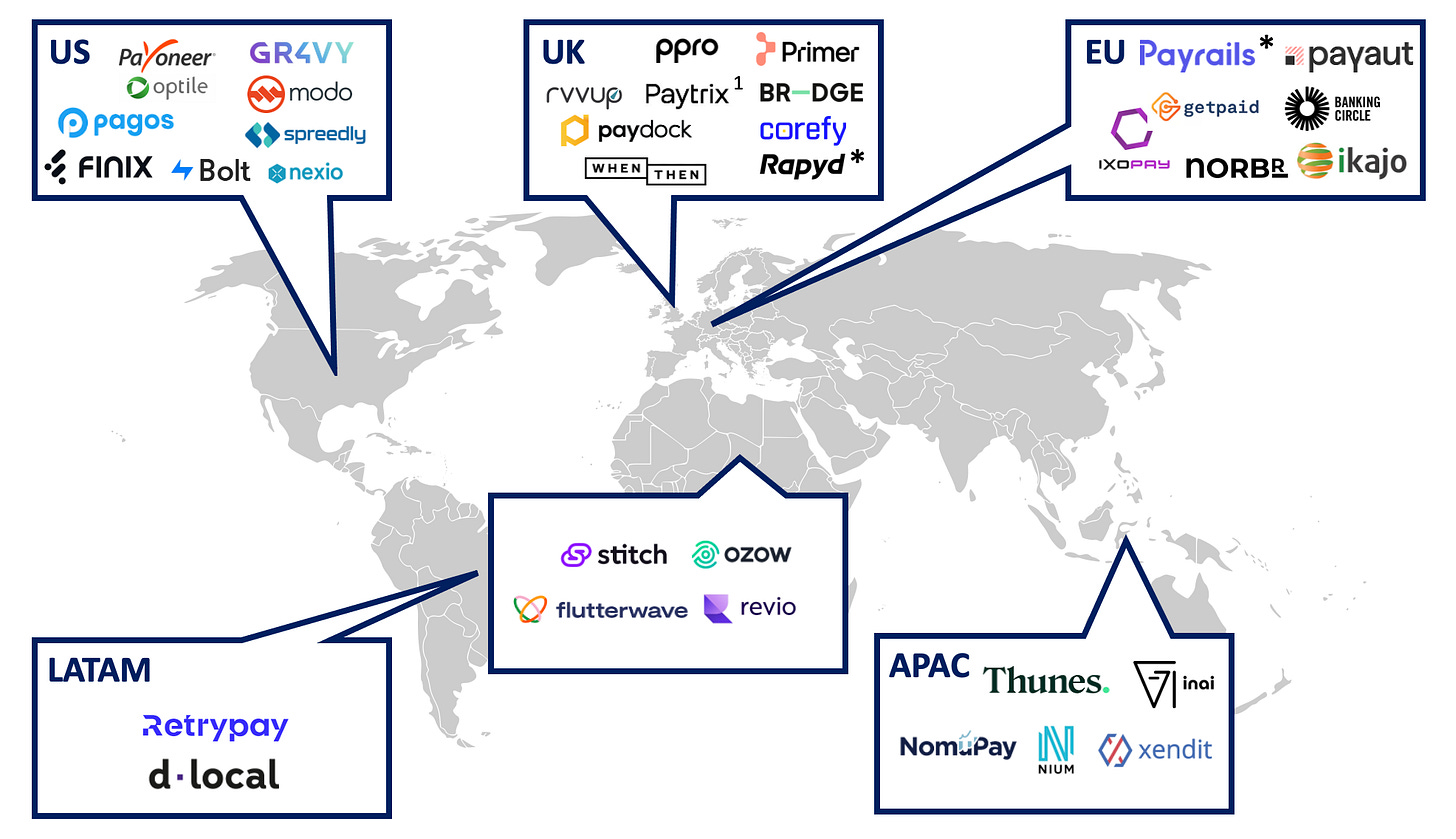

Building a multi-party global payments platform is an enormous challenge - not just from a technological perspective. Most marketplaces that are of a certain scale already have in-house payments teams and functionalities that are mission critical and therefore difficult to replace. The go-to-market for emerging multi-party payments solutions - even with the perfect and most comprehensive platform - remains challenging. We are very excited to see a number of bold founders standing up for this challenge around the globe.

Go-to-market?

We believe the perfect first customers are mid-sized marketplaces that currently run on a one-stop shop solution and are starting to think about global expansion, ways to decrease payment service provider (PSP) dependency, improve pricing and optimise conversion. In other words, it is best to catch these marketplaces before they start the ‘internal build’.

As we see it the real revenue opportunity lies with large and global marketplaces which will already have in-house payments operations but suffer from the complexity and cost of maintaining their payments network. We believe the best way to capture this customer base is to unbundle and provide targeted products that solve the most immediate needs of the merchant - whether that is reconciliation, multi-currency pay-outs or split payments.

In our view, to win all, any emerging multi-party payments platform will need to have both a unified solution for mid-sized marketplaces, and an enterprise sales strategy unbundling that unified solution in order to onboard the largest marketplaces as customers.

Technology?

As already discussed there is A LOT to build. Broadly, we see that players have chosen one of the following categories to start:

Pay-ins (tokenisation, optimising payment routing and intelligence): Payments ‘orchestrators’ (such as Primer, Gr4vy, Norbr) are looking to simplify the integration between merchants and PSPs to manage online payments flows in order to simplify the process of bringing money into a business by accepting and adding different payment methods. They solve an immediate pain point for merchants looking to upgrade from a one-stop shop to multi-PSP payment acceptance. Some platforms go beyond simply building connectivity to PSPs; they further optimise the pay-in process by incorporating KYC/KYB requirements across different regulatory regions, managing complex customer onboarding journeys, tokenising and routing transactions for best execution. Thoughtful prioritisation of PSP integrations, based on the needs of the key target customer category, is critical to scale a pay-ins platform efficiently.

Record keeping: (ledgers and reconciliation): We believe a reconciliation tool can be a great insertion point to land a global marketplace, as we have seen with Modern Treasury which is used by a number global marketplaces like ClassPass* and Outdoorsy. However, merchants will allocate a larger share of wallet for payments/the actual movement of money, so in our view record keeping should be coupled with pay-ins and/or pay-outs.

Pay-outs (multi-currency, cross-border, split payments): Multi-currency payments platforms are looking to simplify the process of sending payments out (today initiating bank transfers can involve a number of manual steps such as sending emails, sharing csv files and spreadsheets). They offer a bundled set of bank connections, hosting accounts in multiple currencies with local collections and access to direct payment rails (in other words ‘localised pay-outs’) via one contract and a single API. Some payments platforms strive to do this without being regulated - providing connectivity to third party regulated fintechs like Hyperwallet and Wise instead. Regulated payments platforms offering localised pay-outs are able to insert themselves directly in the flow of funds architecture (meaning they work directly with a bank).

The Switzerland positioning: to be or not to be in the funds flow?

To position oneself as Switzerland commonly refers to retaining diplomatic independence. In the world of payments, this means having autonomy from network-of-networks/third party providers and being able to achieve the best possible payments routing for your clients without compromising on your business model.

The global payment orchestration market size was valued at $1.1Bn in 2022 (Grand View Research) - surprisingly not that large a TAM. Considering that orchestration is a layer that sits on top of pay-ins and pay-outs providers to optimise costs and conversion, orchestrators’ pricing will always be limited to the costs they save and revenues they optimise for their customers.

Being regulated gives multi-party payments platforms the right to hold funds and process payments. Multi-party payments platforms considering whether to be in the flow of funds (meaning money will, at some point, pass through their bank accounts) or not should consider the following:

On the pay-outs side, the profit margin opportunity is much larger, if the technology provider/payments platform sits directly in the funds flow to move money, collect and distribute payments. Being outside the flow of funds means relying on third-party providers and not gaining direct access to payments ledgers, e.g. for reconciliation and refunds. In addition, the pressure from regulators on network-of-networks is increasing (e.g. dLocal recent news) and even the payments platforms that are not in the flow of funds today might require regulation at scale. For these reasons multi-party payments platforms should at some point consider getting regulated and embedding themselves directly in the funds flow for pay-outs.

On the pay-ins side, however, the problem with going into the funds flow is that you ultimately become the payments processor, meaning you lose your Switzerland independent positioning. Multi-party payments platforms of the future focussing on pay-ins will want to achieve ‘Switzerland’ positioning, given the myriad of payment methods that exist globally. This will guarantee the best execution for their customers, the lowest cost and highest conversion by routing the payment to the best processor for the transaction.

Getting regulated to sit in the flow of funds makes sense to achieve higher profit margins, but pay-in providers should steer clear from processing payments if they want to maintain their favourable Switzerland positioning long-term.

The end-state: fragmented solutions or a single source of truth?

Five years from now: it is possible that the market remains fragmented. A new generation of modern payments platforms is already emerging that specialise in pay-ins, pay-outs or record-keeping. Unbundling is always how it all starts, but the ultimate category defining company will excel on all aspects of multi-party payments and will ultimately become the single source of truth for marketplace payments operations globally.

Disclaimer

Views expressed through media like this site (including podcasts, videos, newsletters, and social media) are those of the individual GC or MCM associate who created or wrote the content and are not the views of General Catalyst Group Management, LLC, (“GC”), Motive Capital Management, LLC (“MCM”) or their respective affiliates. GC and MCM are investment advisers registered with the Securities and Exchange Commission. Additional important information about GC and MCM, including Form ADV Part 2A Brochure for each firm, is available at the SEC’s website: http://www.adviserinfo.sec.gov

Content created by individual GC and MCM associates is not directed to any investors or potential investors, and do not constitute an offer to sell — or a solicitation of an offer to buy — any securities, cryptocurrencies, or any financial instrument or property, and may not be used or relied upon in evaluating the merits of any investment. Nothing here should be construed as or relied upon in any manner as investment, legal, tax, or other advice. Any projections, estimates, forecasts, targets, prospects, or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Any charts or figures provided here are for informational purposes only, and should not be relied upon when making any investment decision. Certain information contained in the content has been obtained from third-party sources. While taken from sources believed to be reliable, no one has independently verified such information and there are no representations about the enduring accuracy of the information or its appropriateness for a given situation.

To the extent any content authored or provided by any GC or MCM associate in this forum or medium makes reference to any company in which any of the funds or vehicles advised by GC or MCM may have an economic or financial interest, previous or current, none of the information provided or opinions expressed herein are connected in any way with GC’s or MCM’s business activities, and GC and MCM did not provide any information or assistance in the creation of this content.

*Represents a GC portfolio company. Any GC portfolio companies mentioned, referred to, or described herein are not representative of all GC investments, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A full list of investments is available upon request.

1.Represents an MCM portfolio company. Any MCM portfolio companies mentioned, referred to, or described herein are not representative of all MCM investments, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A full list of investments is available upon request.

I'm surprised Stripe Connect doesn't show up here! https://stripe.com/connect