The embedded banking space is increasingly crowded, but over the next few years we will see a wave of specialization followed by consolidation. What follows is a brief overview of what embedded banking is before we dive into what we expect to see on the BaaS horizon.

What is ‘embedded banking’?

Embedded banking, or otherwise known as ‘Banking-as-a-Service’ (BaaS), is the process of ‘compartmentalizing’ traditional bank functionality, then ‘offering each function to non-financial companies’ (Eeti, 2021).

Financially unregulated companies, which includes consumer brands but also some fintechs, can then build new products using BaaS players’ banking services to enhance their existing product offering and supply financial services safely to their customers.

For example, Raisin, a savings marketplace, embedded Starling Bank’s account opening and transaction processing API infrastructure to bring more partner banks into the savings marketplace for consumers.

Pure embedded banking players offer savings or current accounts and debit cards — services that might traditionally be understood as transaction banking (i.e. banking that covers ‘day-to-day transaction needs and operations’). Gobank, a banking service provider, is an example of pure embedded banking, providing Uber drivers with debit cards (Raspa, 2020).

Europe: BaaS 1.0 vs BaaS 2.0

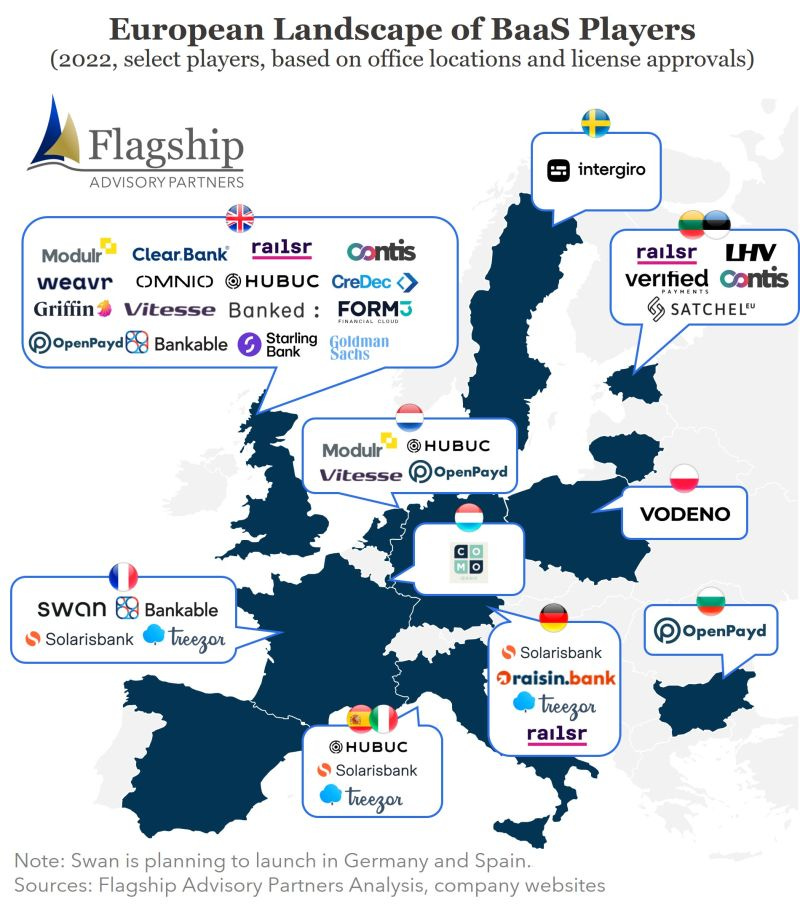

BaaS emerged in Europe with companies like Solarisbank and Railsr (formerly Railsbank) focusing on middleware and primarily serving other fintechs to enable their core offering. Fintechs such as expense management software providers (e.g. Spendesk) manage their customers' money. Therefore, they are obliged by the regulator to hold their customers’ funds in segregated bank accounts. To do this, they either need to become a bank (which is a slow and expensive process) or partner with a traditional bank (which are slow and expensive…)

BaaS 2.0. companies such as Swan and Weavr are emerging in Europe to primarily target non-fintechs. They enable non-fintechs to move away from reselling to embedding fintech offerings, in turn improving their profitability. This approach significantly expands the addressable market for BaaS companies, which goes beyond neobanks and spend management companies and includes consumer brands, marketplaces, and on-demand companies such as Classpass, Uber, Getir, Apple and Google.

To be or not to be licensed?

The reason BaaS providers continue to push the boundaries of innovation is that they are free from the underlying legacy technology and operating constraints that come with being a traditional bank.

Another reason some BaaS providers can innovate quickly is because they choose to partner with traditional banks instead of acquiring their own licenses. Licensed banks rent out their banking licenses, necessary to make transactions financially secure and compliant, to BaaS players. BaaS players can then offer modular banking solutions through API technology while avoiding lengthy license application procedures and expensive capital requirements.

Although this strategy enables quick go-to-market, it also makes non-regulated BaaS players dependent on 3rd parties. The BaaS provider won’t have complete control over customer experience, which could mean slower on-boarding and scaling. They will also suffer from lower margin and lose out on monetization opportunities from holding and lending/leveraging deposits.

Our view is that the winning BaaS players in Europe will have their own licenses, as this will allow them to reduce counter-party risk and own the customer journey. Swan, for example, holds an EMI license, which allows them to offer payment services, but not operate as a ‘bank’, raising a question around the very definition of ‘BaaS’. Ultimately, the underlying banking license determines the type of products that can be offered (Flagship Advisory Partners). This makes us question if Swan is really rather ‘payments as a service’ than BaaS. In the long term the definition of ‘Banking-as-a-Service’ should surely be to hold a banking license.

Over time, BaaS will develop into ‘platform-as-a-service’ as licensed BaaS players will not only be offering their services to non-licensed players, but also to other license holders, e.g. traditional banks such as ING, who cannot deliver the same technology.

Specialization

Specialization is a significant move away from the end-to-end model traditional banks followed in the past.

Any further unbundling will require new technologies and capabilities. Already fintechs are emerging to intermediate BaaS relationships, such as Treasury Prime and Bond. Other fintechs are emerging to create new monetization opportunities for BaaS players, such as Cambr, a deposit monetization platform.

Further unbundling opportunities will arise through banks changing their business models, e.g., to pay-for-use monetization, but also through a further breakdown of the user interface, compliance and risk management functions.

Power shift summary

We see traditional bank functionality being broken down into specialized functions where different companies excel at doing what was traditionally undertaken entirely by banks. After specialization, there will likely be consolidation of different BaaS players with different strengths across Europe, as already seen with Solaris’ acquisition of Contis. Due to the specific geographic and regulatory requirements in Europe, and the general lack of harmonization across Europe, we expect there to be multiple frontrunners even after consolidation.

In the long run, the BaaS players which hold banking licenses will have the upper hand as they reduce counterparty risk and own their own customer journeys. In that scenario, we are converging back to a new version of the original ‘Bank direct to customer’ model where banks owned the entire relationship from holding licenses to owning the end customer relationship with the major difference that some financial capabilities, products, and intelligent services are now delivered using API technology.

Eventually, the innovation will come full circle and a power will shift from traditional banks to BaaS players.

Any other interesting thoughts/features/angles that we've missed? Feel free to contact us.

Disclaimer

Views expressed through media like this site (including podcasts, videos, newsletters, and social media) are those of the individual GC associate who created or wrote the content and are not the views of General Catalyst Group Management, LLC, (“GC”) or its respective affiliates. GC is an investment adviser registered with the Securities and Exchange Commission. Additional important information about GC, including our Form ADV Part 2A Brochure, is available at the SEC’s website:

http://www.adviserinfo.sec.gov

Views expressed through media like this site (including podcasts, videos, newsletters, and social media) are those of the individual EC associate who created or wrote the content and are not the views of embedded capital group (“EC”) or its respective affiliates.

Content created by individual GC and EC associates is not directed to any investors or potential investors, and do not constitute an offer to sell — or a solicitation of an offer to buy — any securities, cryptocurrencies, or any financial instrument or property, and may not be used or relied upon in evaluating the merits of any investment. Nothing here should be construed as or relied upon in any manner as investment, legal, tax, or other advice. Any projections, estimates, forecasts, targets, prospects, or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Any charts or figures provided here are for informational purposes only, and should not be relied upon when making any investment decision. Certain information contained in the content has been obtained from third-party sources. While taken from sources believed to be reliable, no one has independently verified such information and there are no representations about the enduring accuracy of the information or its appropriateness for a given situation.

To the extent any content authored or provided by any GC or EC associate in this forum or medium makes reference to any company in which any of the funds or vehicles advised by GC or EC may have an economic or financial interest, previous or current, none of the information provided or opinions expressed herein are connected in any way with GC’s or EC’s business activities, and GC and EC did not provide any information or assistance in the creation of this content.

Interesting thoughts. I especially liked your train of thought for why owning the license internally is long-term the better approach – this was precisely our reasoning when starting Swan. I’m sure American players would also make this choice if it were easier to get a license there. The European Union can be proud of the level playing field brought by the EMI license & passport system.