The Future of Fintech: Embedded Everything

What is embedded finance?

The last decade in financial technology was about platforms and open banking. The decade before that was about digitizing customer journeys.

In the past few years, we entered a new era of innovation in fintech infrastructure with the rise of embedded finance. We’ve all heard it before: ‘Every company will be a fintech company’ and we will continue to hear it as a growing number of startups are enabling companies across a variety of sectors to offer embedded financial services as part of their core value proposition.

Embedded finance emerged in Europe in response to new regulations, such as PSD2 in the EU and Open Banking in the UK. The first wave of infrastructure players such as Truelayer and Tink led the way by building API connectivity platforms to bring these regulations into practice. Now, the trend has officially taken over Europe, with companies like Railsbank, Mambu, Swan and Solarisbank enabling non-fintechs to offer verticalized financial products globally. These verticals include payments, card payments, banking, insurance, investments and lending.

The embedded finance ecosystem can be broken down to two groups:

(1) Non-financial companies, whose value proposition is significantly enhanced by adding financial products and services to their existing offering. Examples include tech giants like Uber with UberMoney, Google with its banking and payments platform and Amazon (see image below). However, enterprises and SMEs in every imaginable sector also fall into this category.

(2) Fintechs that enable companies in category 1 to provide embedded financial solutions. Examples include Marqueta providing Uber’s global card-issuing technology, Plaid’s API providing easier deposits and funding for European Kraken customers, and Mambu powering Tide’s revolving credit and overdrafts.

Forget software, fintech is eating the world...

Embedded finance is estimated to generate c.$230bn in revenue by 2025 (Lightyear Capital). At a 5x revenue multiple, this will create a market opportunity of c.$1tn of value by 2025. Other estimates are less conservative, estimating that embedded finance already had a market value of $3.6tn in 2020 and that it will reach c.$7tn by 2030 - the latter being twice the combined value of the world’s top 30 banks today. A survey conducted by Plaid and Accenture revealed that c.85% of non-financial companies that have chosen to enhance their existing offering with embedded financial services were successful at increasing engagement levels and attracting new customers.

It’s not surprising that this is driving a significant growth in venture capital investments into fintech. In 2021, the fintech sector received $132bn of global funding - an increase of 168% from 2020.

Global funding into fintech ($ billions):

Source: CB Insights

We have identified four underlying trends that will shape the future of companies’ embedded service offering in Europe and beyond:

a) Embedded finance companies piggy-backing on their customers’ growth

Embedded finance companies have an edge in distributing financial services. They directly benefit from the growth of their customers, without the need to run full-stack operations, create transactional infrastructure or handle risk management - thereby avoiding the hurdles of ‘traditional’ fintechs. In addition to sidestepping these requirements, by piggy-backing onto the growth of their customers, embedded finance companies secure a low CAC and high LTV. The growth of Venmo and Robinhood were significant drivers in Plaid’s growth. The growth of e-commerce (and let’s call out Peloton specifically here) during covid lockdown was a driver in Affirm and Klarna’s growth.

b) Finance is composable: rise of API technology

API technology can enable seamless integration of financial products right at the point of interaction. Banking APIs can be leveraged, for example, by online merchants choosing to embed a BNPL offering through Two or Zilch, configuring the best in class players for each product category.

There is an inherent friction in this high level of modularity. Even though the different integrations may be easily configurable, maintaining these integrations may be difficult. Platforms, like Toqio, Transactionlink and Sikoia, are aiming to overcome this hurdle by maintaining different API connections and by becoming discovery and one-stop integration platforms for embedded finance solutions.

As embedded finance is adopted more widely, companies will prefer to work with one provider to cover different product use cases rather than managing integrations across different providers. That’s where multi-service embedded finance providers come in.

c) Convergence towards multi-service embedded offerings

In most cases, the leading embedded finance companies of today initially entered the market with only one use case. Plaid, for example, started off building their own bank integrations. Now, its service offering encompasses a whole suite of APIs from transactions to identity checks and payment initiation.

We predict that the ultimate embedded finance winners will be the ones that have a vision to become multi-service providers. Offering more than one embedded financial service allows these players to service a wider variety of companies with varying product needs - they will be stickier than embedded finance companies that focus on offering only one particular financial product or service vertical.

d) Embedded finance is closing gaps in customer journeys

Furniture businesses and car companies have been selling insurance and finance on their products since the 60s. The revolutionary thing about embedded finance is that it isn’t offered by a separate partner, but it can be white-labeled and built into the UX flow at the point of sale.

Eliminating this disjointedness is one of the major benefits of embedded finance. Embedding financial products allows brands to increase customer engagement and retention. It’s not only a way to differentiate from competition, but also a cross-sell opportunity to improve LTV/CAC.

In some cases, non-fintechs are better positioned to provide financial products to their customers than traditional fintechs, as they already have a significant amount of data on their customers. For example, Shopify can offer its customers loans without a lengthy application process because of its access to proprietary transaction data, visibility into cash flows for underwriting and direct access to payments flow to deduct payments from future sales. The embedded lending company Wayflyer is able to provide a similar revenue-based financing solution to e-commerce customers by using the proprietary data collected via it’s analytics services. Both companies beat banks and traditional third-party lenders in speed and convenience.

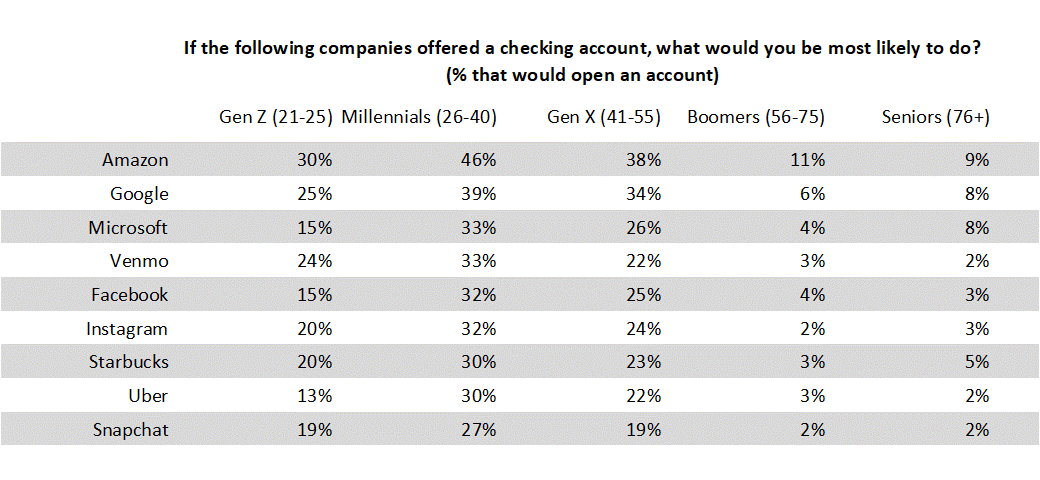

We are also encouraged by growing consumer openness and trust in non-traditional fintech providers with financial services. A survey conducted by Cornerstone Advisors revealed that many consumers under the age of 55 are open to creating, for example, a checking account with non-traditional fintech-enabled providers, such as Google, Amazon, Starbucks or Uber.

Embedded finance landscape

We have mapped some of the most promising European players in the space. Please let us know which ones we missed!

Offering more than one embedded financial service allows these players to service a wider variety of companies with varying product needs. Fintech has had a tremendous influence on how we handle money, either privately or commercially. Things that once took days or weeks can now be done in a matter of minutes. You can also read this article https://www.tejkohli.co.uk/understanding-fintech/ to know more.

https://linxoconnect.com/ and https://www.linxo.com/